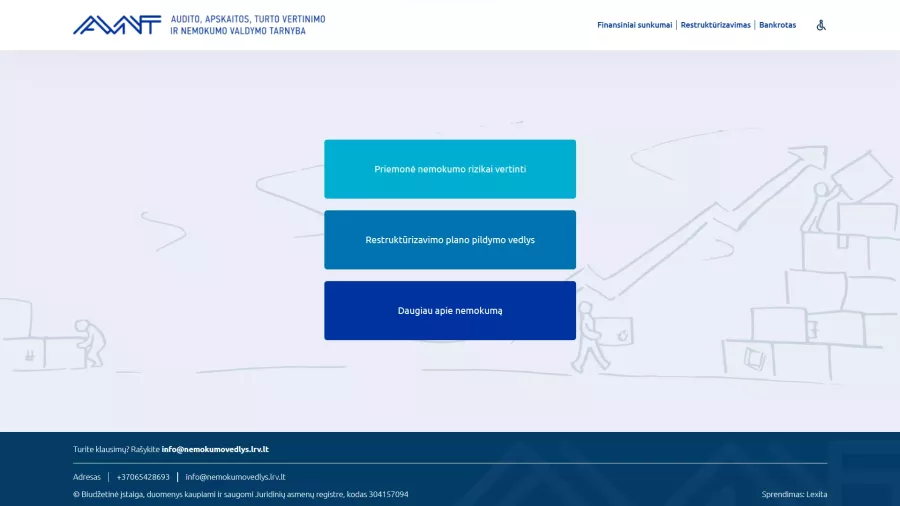

Created the information system "Nemokumo vedlys"

The information system "Insolvency Guide" is designed for small and medium-sized enterprises to assess their debt risk and obtain necessary information about recommended actions for legal or natural persons.

The "Insolvency Guide" information system consists of 3 modules:

Tool for Assessing Insolvency Risk

The first module is the “Tool for Assessing Insolvency Risk,” designed to evaluate your company's activities and insolvency risk. By answering a few questions related to your company's condition, the system will automatically generate recommendations with suggestions and information on reducing insolvency risk and overcoming financial difficulties based on your provided answers.

If the questionnaire indicates a high insolvency risk, the user will be able to directly access the restructuring plan guide, read more information about insolvency, or fill out the questionnaire again.

Restructuring Plan Preparation Guide

This module of the information system includes a digital tool that allows companies to create a restructuring project in compliance with legal regulations. This digital tool operates on a ten-step principle and is tailored for small and medium-sized businesses, but anyone can use it.

While filling out the restructuring guide, the company representative must provide general information about the legal entity, its obligations, commitments, financial condition, and the financial difficulties it faces. Then, they must enter creditors and their demands and how they will be satisfied. Based on the formulas integrated into this digital tool, administrative costs of the restructuring process will be calculated, along with other important information for this process. To facilitate and speed up this filling process, the system will automatically fill in fields where the information repeats. After completing the restructuring guide, the system will generate a printable document containing your individual restructuring plan.

Since the system requires entering certain personal data, such as creditors, debtors, and financial report data, the system ensures that your data will not be stored in the system for more than three days after closing the system.

More About Insolvency

In the third module, “More About Insolvency,” we have highlighted three topics (Restructuring of Legal Entities, Bankruptcy of Legal Entities, Bankruptcy of Natural Persons) where system users can find more relevant information. This information is presented in a FAQ (Frequently Asked Questions) format, making it easy for the system visitor to find information on the topic they are interested in. Each topic option also includes links to legal acts, recommendations, court practice summaries, and sample forms according to the chosen topic.